As 10 Common Car Finance Mistakes You Should Never Make takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

Introduction

Car finance mistakes refer to errors or misjudgments made during the process of obtaining financing for a vehicle purchase. These mistakes can have serious financial repercussions and can affect your overall financial well-being. It is crucial to avoid these mistakes to ensure you make sound financial decisions and secure the best possible terms for your car loan.Avoiding these mistakes is important because they can lead to higher interest rates, longer loan terms, and ultimately cost you more money in the long run.

By steering clear of these pitfalls, you can save yourself from unnecessary financial strain and ensure that you get the most value out of your car purchase.Some of the consequences of making car finance mistakes include damaging your credit score, paying more in interest over time, and potentially facing repossession of your vehicle if you are unable to keep up with payments.

It is essential to be aware of these pitfalls and take proactive steps to avoid them when securing financing for your next vehicle.

Lack of Research

Researching before committing to a car finance plan is crucial to avoid making costly mistakes. Proper research can help you find the best deal that suits your financial situation and needs. Here are some tips on where to research different car finance options:

Importance of Research

- Check online reviews and ratings of different lenders to gauge their reputation and customer satisfaction levels.

- Compare interest rates, loan terms, and fees from multiple lenders to ensure you are getting the most competitive offer.

- Consult with financial advisors or experts to get personalized advice on the best car finance options based on your specific circumstances.

Ignoring Credit Score

Ignoring your credit score when applying for car finance can be a costly mistake. Your credit score plays a crucial role in determining the interest rates you will be offered and whether you will be approved for a car loan.

It reflects your creditworthiness and financial responsibility, so it's essential to pay attention to it before applying for car finance.

Significance of Credit Score in Car Financing

Your credit score is a major factor that lenders consider when determining your eligibility for a car loan. It provides them with an insight into your past credit history and helps them assess the level of risk involved in lending you money.

A higher credit score indicates to lenders that you are a less risky borrower, resulting in better interest rates and loan terms.

How Credit Score Affects Interest Rates

A higher credit score typically translates to lower interest rates on your car loan. Lenders see borrowers with higher credit scores as more likely to repay their loans on time, so they offer them more favorable terms. On the other hand, a lower credit score may lead to higher interest rates, which can significantly increase the overall cost of borrowing for a car.

Tips on Improving Credit Score Before Applying for Car Finance

- Check your credit report for any errors and dispute inaccuracies.

- Pay your bills on time to establish a positive payment history.

- Reduce your credit card balances to lower your credit utilization ratio.

- Avoid opening new credit accounts before applying for a car loan.

- Consider using credit-building tools such as secured credit cards to improve your score.

Overlooking Hidden Fees

When it comes to car financing, many people make the mistake of overlooking hidden fees that can significantly impact the total cost of the loan. These fees are often buried in the fine print of the loan agreement, making them easy to miss if you're not paying close attention.

By understanding the common hidden fees in car financing, you can avoid unnecessary expenses and make a more informed decision.

Common Hidden Fees

- Origination Fees: These are fees charged by the lender for processing the loan application. They can range from 1% to 5% of the total loan amount.

- Prepayment Penalties: Some lenders charge a fee if you pay off your loan early. This can deter you from saving money on interest by paying off the loan ahead of schedule.

- Documentation Fees: These fees cover the cost of preparing the loan documents and can add several hundred dollars to the total cost of the loan.

- Extended Warranty Fees: If you opt for an extended warranty on your vehicle, be aware that this can be rolled into your loan amount, increasing the overall cost.

Long Loan Terms

When it comes to car financing, opting for long loan terms may seem like an attractive option at first. However, there are significant risks associated with choosing an extended repayment period for your car loan.

Risks of Long Loan Terms

- Increased Interest Costs: Long loan terms typically come with higher interest rates, leading to a significant increase in the total amount you pay over the life of the loan.

- Negative Equity: With a longer loan term, you may find yourself owing more on the car than it's worth, making it challenging to sell or trade-in the vehicle.

- Extended Debt Burden: Long loan terms mean you'll be in debt for a more extended period, impacting your overall financial health and limiting your ability to save or invest.

Choosing the Right Loan Term

- Evaluate Your Financial Situation: Consider your income, expenses, and financial goals to determine the loan term that aligns with your budget and long-term plans.

- Shorter Terms for Lower Total Costs: Opt for the shortest loan term you can afford to minimize interest costs and pay off the loan faster.

- Balancing Monthly Payments: Find a loan term that strikes a balance between manageable monthly payments and a reasonable repayment period to avoid financial strain.

Focusing Only on Monthly Payments

When it comes to car financing, focusing solely on monthly payments can be a common mistake that many people make. While it is essential to consider what fits within your budget on a monthly basis, it is equally important to look at the bigger picture.When you only focus on monthly payments, you may end up stretching out your loan term to lower the monthly amount.

However, this can lead to paying more in interest over the life of the loan, ultimately increasing the total cost of the car. It's crucial to consider the total cost of the loan, including interest rates and fees, to ensure that you are getting the best deal.

Importance of Considering the Total Cost of the Loan

- Looking at the total cost of the loan allows you to see the overall financial impact of your car purchase. It gives you a clear picture of how much you will be paying in total, including interest and fees.

- By considering the total cost, you can make a more informed decision about whether a particular loan is affordable for you in the long run. It helps you avoid being blindsided by hidden costs that may arise.

- Understanding the total cost of the loan also helps you compare different financing options effectively. You can see which loan offers the best overall value and choose the one that aligns with your financial goals.

Impact of Other Factors on Affordability of a Car Loan

- Interest Rates: Higher interest rates can significantly increase the total cost of the loan. It's crucial to shop around for the best interest rate to save money in the long run.

- Loan Term: A longer loan term may lower your monthly payments but can result in paying more in interest over time. Consider a shorter loan term if possible to reduce the total cost.

- Down Payment: Making a larger down payment upfront can reduce the amount you need to finance, lowering the total cost of the loan and potentially securing better loan terms.

Not Getting Pre-Approved

Getting pre-approved for a car loan is a crucial step that many car buyers overlook. By getting pre-approved, you can have a better understanding of your budget and the interest rates you qualify for before heading to the dealership. This can save you time and hassle during the car shopping process.

Benefits of Getting Pre-Approved

- Knowing your budget: Pre-approval gives you a clear idea of how much you can afford to spend on a car.

- Interest rates: You can compare offers from different lenders and choose the best interest rate available to you.

- Streamlined process: Having a pre-approval letter can speed up the buying process at the dealership.

How Pre-Approval Helps in Negotiating a Better Deal

- Stronger bargaining position: With a pre-approval in hand, you have more negotiating power with the dealer.

- Focus on the price: Instead of discussing financing options, you can focus on negotiating the price of the car.

- Avoid dealer markups: Dealers may try to increase the interest rate or add unnecessary fees if you are not pre-approved.

Tips on How to Get Pre-Approved for Car Financing

- Check your credit score: Before applying for pre-approval, review your credit report and address any issues that could affect your loan terms.

- Shop around for lenders: Compare offers from banks, credit unions, and online lenders to find the best rates and terms.

- Gather necessary documents: Be prepared to provide proof of income, employment, and residence when applying for pre-approval.

- Apply online: Many lenders offer online pre-approval applications that can provide quick decisions and convenience.

Choosing the Wrong Loan Type

When it comes to car financing, choosing the right loan type is crucial to ensure you get the best deal possible. There are various options available, such as dealership financing, bank loans, and credit unions. Each type of loan comes with its own set of pros and cons, so it's essential to understand them before making a decision.

Comparison of Loan Types

- Dealership Financing: This type of financing is convenient as you can get it directly from the dealership where you purchase your car. However, the interest rates may be higher compared to other options.

- Bank Loans: Getting a loan from a bank may offer lower interest rates, especially if you have a good credit score. You can also negotiate the terms of the loan directly with the bank.

- Credit Unions: Credit unions often provide competitive interest rates and personalized service. However, membership requirements may apply.

It's essential to compare the interest rates, terms, and fees associated with each loan type to determine which option is the most cost-effective for you.

Choosing the Right Loan Type

- Evaluate your credit score and financial situation to determine which loan type suits you best.

- Consider the interest rates, loan terms, and fees associated with each option to make an informed decision.

- Get pre-approved for a loan to have a better understanding of the offers available to you before visiting dealerships.

Skipping Reading the Fine Print

When getting a car loan, it's crucial to pay attention to every detail, especially the fine print in the loan agreement. Many borrowers make the mistake of skipping this important step, which can lead to misunderstandings and financial troubles down the road.

Importance of Reading and Understanding the Terms

- Ensure you understand the interest rates, fees, and penalties associated with the loan.

- Clarify the repayment schedule, including any grace periods or prepayment options.

- Be aware of any clauses related to insurance requirements or vehicle warranties.

Common Clauses to Look Out For

-

Penalties for early repayment or late payments

-

Adjustable interest rates that can increase over time

-

Requirements for specific insurance coverage

Tips for Reviewing the Fine Print

- Take your time to read through the entire agreement carefully.

- Ask questions about any terms or clauses that are unclear to you.

- Seek advice from a financial advisor or lawyer if needed.

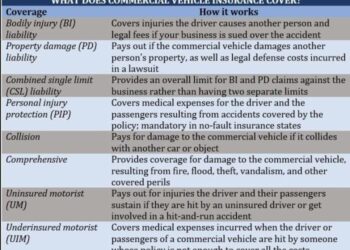

Not Considering Insurance Costs

When getting a car finance plan, many people overlook the impact of insurance costs on the overall expenses of owning a vehicle. It's crucial to factor in insurance premiums to avoid financial surprises down the road.

Factors Affecting Insurance Costs

- The type of car model you choose can significantly influence insurance premiums. Sports cars or luxury vehicles often come with higher insurance rates due to their higher risk of theft or accidents.

- Your driving history plays a crucial role in determining insurance costs. A clean driving record will usually result in lower premiums, while accidents or traffic violations can lead to increased rates.

- The coverage options you select also impact insurance costs. Comprehensive coverage for a new car will be more expensive compared to basic liability coverage for an older vehicle.

Estimating Insurance Costs

Before committing to a car finance plan, it's essential to obtain insurance quotes for the specific make and model you are considering. You can use online tools or consult with insurance agents to get an estimate of the annual insurance premium.

- Consider factors like your age, location, and driving history when getting insurance quotes. Younger drivers and those living in high-crime areas may face higher premiums.

- Compare quotes from multiple insurance providers to find the best coverage at a competitive price. Don't forget to inquire about discounts for safe driving habits or bundling policies.

Final Wrap-Up

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQ

What is the significance of credit score in car financing?

The credit score plays a crucial role in determining the interest rates for car loans. A higher credit score usually leads to lower interest rates, saving you money in the long run.

Why is it important to get pre-approved for a car loan?

Getting pre-approved helps you understand how much you can borrow and the interest rate you qualify for, giving you leverage when negotiating with dealers.

What are some common hidden fees in car financing?

Some hidden fees include processing fees, late payment fees, and early repayment penalties. It's crucial to be aware of these fees to avoid unexpected costs.

How can one estimate insurance costs before committing to a car finance plan?

You can estimate insurance costs by considering factors like the car model, driving history, and coverage options. Getting insurance quotes from different providers can also help you get an idea of potential costs.