Embarking on the journey of purchasing auto insurance can be daunting, with numerous pitfalls waiting to ensnare the uninformed. In this guide, we delve into the 5 Mistakes to Avoid When Shopping for Auto Insurance, shedding light on common errors that can cost you dearly if not sidestepped.

Exploring each mistake in detail, we aim to equip you with the knowledge needed to make informed decisions and secure the right coverage for your vehicle.

Common Mistakes in Auto Insurance Shopping

When shopping for auto insurance, it's essential to avoid common mistakes that could end up costing you more money or leaving you underinsured. By being aware of these pitfalls, you can make informed decisions that protect both your vehicle and your finances.

1. Focusing Only on Price

One of the most common mistakes people make when shopping for auto insurance is focusing solely on the price. While it's important to find a policy that fits your budget, choosing the cheapest option without considering coverage limits and deductibles can leave you vulnerable in the event of an accident.

For example, opting for the lowest liability limits may save you money on premiums, but it could mean having to pay out of pocket for damages that exceed your coverage. It's crucial to strike a balance between affordability and adequate coverage to protect yourself financially.

2. Not Comparing Quotes

Another mistake is failing to compare quotes from multiple insurance companies. Each insurer uses different criteria to calculate premiums, so you could be missing out on significant savings by not shopping around.

For instance, one company may offer discounts for safe driving or bundling policies, while another might have lower rates for your specific driving record. By obtaining quotes from several providers, you can find the best value for your coverage needs.

3. Overlooking Coverage Options

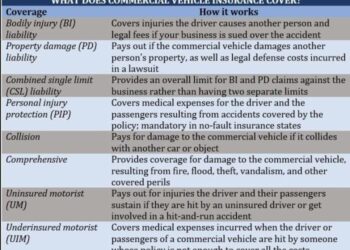

Many people make the mistake of overlooking coverage options that could provide valuable protection in various scenarios. For example, uninsured/underinsured motorist coverage can help cover costs if you're involved in an accident with a driver who lacks insurance or sufficient coverage.

By understanding the available coverage options and their benefits, you can tailor your policy to safeguard against common risks on the road.

4. Providing Incorrect Information

Supplying inaccurate information when applying for auto insurance can lead to issues down the line. Whether it's misrepresenting your driving history or underestimating your annual mileage, providing incorrect details could result in denied claims or policy cancellations.

It's crucial to be honest and thorough when filling out insurance applications to ensure you receive accurate quotes and maintain coverage that aligns with your actual circumstances.

5. Forgetting to Review and Update Policies

Lastly, forgetting to review and update your auto insurance policy regularly can be a costly mistake. Life changes, such as moving to a new location or purchasing a new vehicle, can impact your coverage needs and premiums.

By reviewing your policy annually and making adjustments as needed, you can ensure that your coverage remains up-to-date and continues to provide adequate protection in changing circumstances.

Understanding Coverage Needs

When shopping for auto insurance, it is crucial to understand your coverage needs to ensure you are adequately protected in case of an accident or unforeseen event. Assessing your coverage needs requires careful consideration of various factors, including your driving habits, the value of your vehicle, and your budget.There are several types of coverage available in auto insurance, each serving a different purpose.

Some essential types of coverage include:

Liability Coverage

Liability coverage is mandatory in most states and helps cover costs associated with injuries or property damage you may cause to others in an accident. Without sufficient liability coverage, you may be personally responsible for any expenses exceeding your coverage limits.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if it is damaged in a collision with another vehicle or object. This coverage is especially important if you have a newer or more valuable car.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision related incidents, such as theft, vandalism, or natural disasters. Without comprehensive coverage, you may have to pay out of pocket for damages to your vehicle in these situations.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage provides protection if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. This coverage can help cover your medical expenses and vehicle repairs in such scenarios.

Scenario: Inadequate Coverage

Imagine you are involved in a severe accident where you are at fault, resulting in significant injuries to the other party. If you only have the minimum required liability coverage, you may quickly reach the limits of your policy, leaving you personally liable for the remaining expenses.

This could lead to financial strain and potential legal consequences, highlighting the importance of having adequate coverage to protect yourself and your assets.

Researching Insurance Companies

Researching insurance companies before making a decision is crucial to ensure that you are selecting a reliable and reputable provider. By evaluating insurance companies based on customer reviews, financial strength, and reputation, you can make an informed choice that meets your coverage needs.

Criteria to Evaluate Insurance Companies

- Customer Reviews: Look for feedback from policyholders regarding their experience with the insurance company. Positive reviews may indicate good customer service and claims handling.

- Financial Strength: Check the financial ratings of the insurance company from agencies like A.M. Best, Standard & Poor's, or Moody's. A strong financial rating suggests the company is stable and capable of fulfilling claims.

- Reputation: Research the company's reputation in the industry and among customers. A good reputation can provide peace of mind and confidence in the insurer's ability to deliver on their promises.

Personal Experience with Researching Insurance Companies

When I was shopping for auto insurance, I spent time researching different insurance companies based on the criteria mentioned above. I read reviews from customers, checked financial ratings, and looked into the reputation of each company. This thorough research helped me in selecting an insurance company that not only offered competitive rates but also had a strong track record of customer satisfaction and financial stability.

As a result, I felt confident in my choice and knew that I was adequately protected in case of any unforeseen events.

Avoiding Underinsurance and Overinsurance

When it comes to auto insurance, striking the right balance between adequate coverage and affordability is crucial. Underinsurance and overinsurance are two common pitfalls that can have serious consequences if not properly addressed.

Risks of Underinsurance and Overinsurance

Underinsurance occurs when your coverage limits are too low to fully cover the costs of an accident or other damages. This can leave you financially vulnerable and may result in out-of-pocket expenses that could have been avoided. On the other hand, overinsurance means paying for coverage you don't actually need, leading to unnecessary expenses.

Striking the right balance between the two is essential to ensure you are adequately protected without overpaying for coverage you may never use.

Strategies for Finding the Right Balance

- Assess Your Needs: Evaluate your driving habits, the value of your vehicle, and your financial situation to determine the level of coverage you truly need.

- Compare Quotes: Obtain quotes from multiple insurance companies to find the best coverage options at competitive rates.

- Review Your Policy Regularly: As your circumstances change, such as buying a new car or moving to a new location, make sure your coverage still aligns with your needs.

Consequences of Underinsurance and Overinsurance

A Practical Example

A Practical Example

Imagine you are involved in a major accident where your car is totaled, and the other driver is seriously injured. If you are underinsured, you may be left to cover the medical expenses and vehicle replacement costs out of pocket, putting a significant strain on your finances.

On the other hand, if you are overinsured, you may be paying high premiums for coverage you don't need, diverting money that could be used for other essentials.

Utilizing Discounts and Bundling Options

When shopping for auto insurance, it's essential to take advantage of discounts and bundling options offered by insurance companies. These strategies can help you save money while still getting the coverage you need.

Common Discounts Offered by Insurance Companies

- Good driver discounts for having a clean driving record.

- Multi-policy discounts for bundling auto and home insurance.

- Good student discounts for young drivers with good grades.

- Safety feature discounts for vehicles equipped with safety features like anti-lock brakes or airbags.

- Low mileage discounts for driving fewer miles than the average driver.

Benefits of Bundling Insurance Policies

Bundling your auto insurance with other policies, such as home or renters insurance, can lead to significant savings. Insurance companies often offer discounts for customers who purchase multiple policies from them. Not only does bundling save you money, but it also simplifies your insurance payments by consolidating them into one convenient bill.

Success Story of Maximizing Discounts and Bundling Options

One success story involves a young driver who qualified for both a good student discount and a low mileage discount. By maintaining good grades in school and using public transportation for daily commuting, the driver was able to significantly reduce their auto insurance premiums.

This demonstrates how combining different discounts can result in substantial savings on insurance costs.

Conclusion

Concluding our discussion on the 5 Mistakes to Avoid When Shopping for Auto Insurance, it becomes evident that a cautious approach can save you from potential financial and legal troubles down the road. By steering clear of these pitfalls and arming yourself with the right information, you can navigate the complex world of auto insurance with confidence.

User Queries

What are the consequences of underinsurance in auto insurance?

Underinsurance can leave you vulnerable in case of accidents or damages, leading to out-of-pocket expenses that can be financially devastating.

How can bundling insurance policies help save money?

By bundling multiple insurance policies with the same provider, you can often qualify for discounts, ultimately reducing your overall insurance costs.

Why is it crucial to research insurance companies before choosing a policy?

Researching insurance companies allows you to gauge their reliability, customer satisfaction, and financial stability, ensuring you select a reputable provider.

What types of coverage are considered essential when shopping for auto insurance?

Essential coverage typically includes liability insurance, uninsured/underinsured motorist coverage, and comprehensive/collision coverage to protect you in various scenarios.

How can one strike a balance between adequate coverage and affordability?

By carefully assessing your coverage needs and comparing quotes from different providers, you can find a policy that offers sufficient protection without breaking the bank.