Is Shopify Capital Loan Right for Small Businesses? takes center stage with an intriguing inquiry that beckons readers into the world of small business financing. As we delve into the intricacies of this topic, we aim to provide a comprehensive and engaging overview that will shed light on the suitability of Shopify Capital Loan for small business owners.

In the following paragraphs, we will explore the eligibility criteria, benefits, pros and cons, application process, and more to equip you with the necessary insights to make an informed decision.

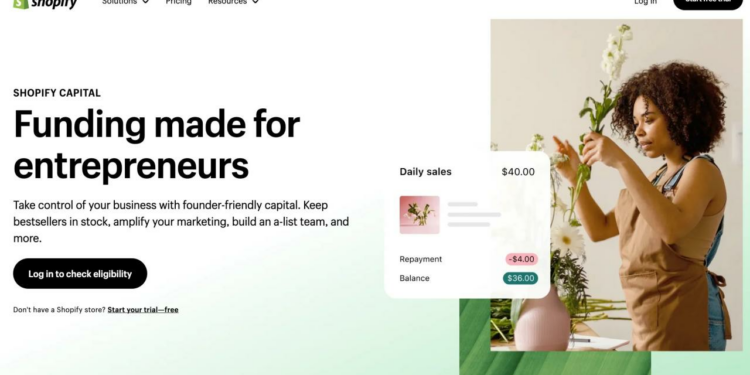

Introduction to Shopify Capital Loan

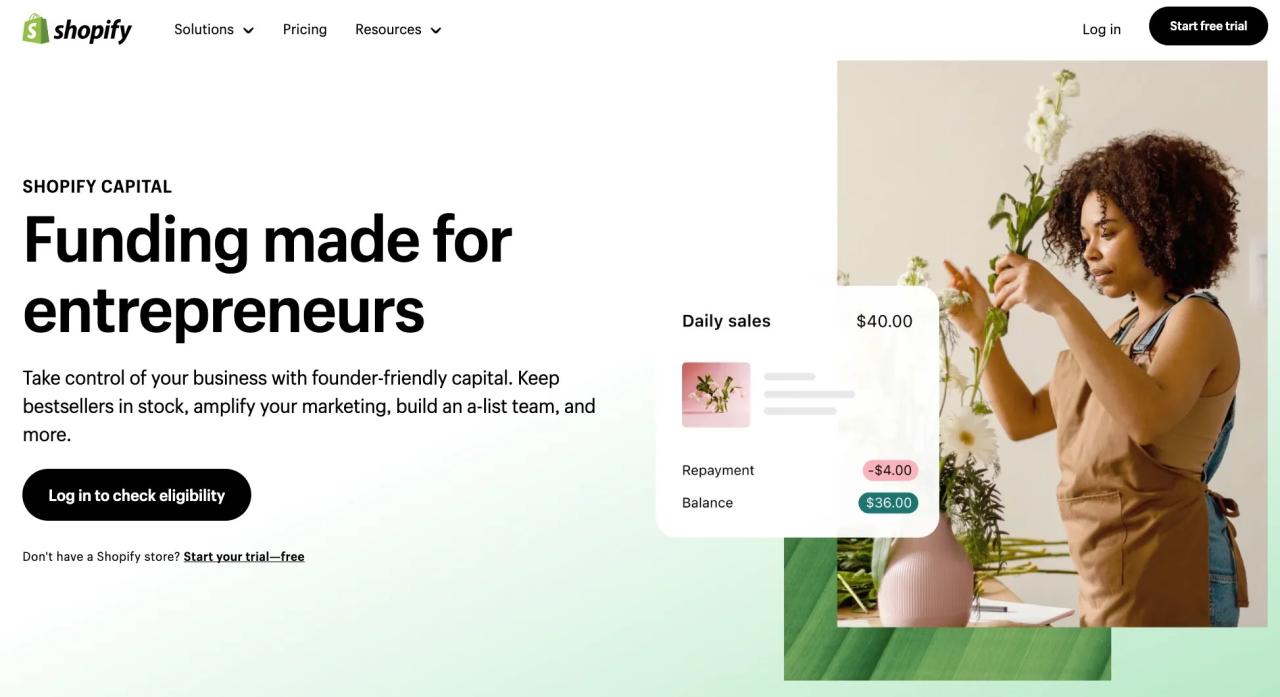

Shopify Capital Loan is a financing option provided by the popular e-commerce platform, Shopify, to help small businesses grow and expand. Unlike traditional lending options, Shopify Capital Loan offers a streamlined application process and quick access to funds.

Eligibility Criteria for Shopify Capital Loan

- Active Shopify store for at least 6 months

- Minimum annual revenue threshold

- Healthy sales history

- Positive customer feedback

Benefits of Choosing Shopify Capital Loan

- Quick and easy application process

- Flexible repayment options based on daily sales

- No fixed monthly payments

- No personal guarantee or collateral required

Pros and Cons of Shopify Capital Loan

Shopify Capital Loan can be a valuable financing option for small businesses, but it also comes with its own set of advantages and limitations.

Advantages of Shopify Capital Loan

- Quick and Easy Application Process: Shopify Capital Loan offers a streamlined application process with minimal documentation requirements, making it convenient for small business owners.

- No Fixed Monthly Payments: Unlike traditional loans, Shopify Capital Loan allows businesses to repay the borrowed amount through a percentage of daily sales, which can be beneficial during slow sales periods.

- No Interest Rates: Shopify Capital Loan charges a fixed fee instead of traditional interest rates, providing more transparency in repayment terms.

- No Credit Check: Shopify Capital Loan doesn't require a credit check, making it accessible to businesses with less-than-perfect credit scores.

Drawbacks of Shopify Capital Loan

- Higher Fees: The fixed fee structure of Shopify Capital Loan may result in higher costs compared to traditional loans with lower interest rates.

- Limited Loan Amounts: Shopify Capital Loan typically offers smaller loan amounts, which may not meet the financial needs of businesses requiring substantial funding.

- Restrictions on Eligibility: Not all businesses may qualify for a Shopify Capital Loan, as eligibility criteria can be restrictive based on sales history and performance on the Shopify platform.

Comparison with Other Financing Options

When comparing Shopify Capital Loan with other financing options available to small businesses, it's essential to consider the interest rates and repayment terms. While traditional bank loans may offer lower interest rates, they often come with stricter eligibility requirements and longer approval times.

On the other hand, alternative online lenders may provide faster funding but at higher interest rates. Shopify Capital Loan falls in between, offering a unique repayment structure and accessibility without the need for a credit check.

Application Process and Requirements

When applying for a Shopify Capital Loan, small businesses need to follow a specific process and provide certain documentation and information. This ensures that Shopify can assess the eligibility of the business and make an informed decision regarding the loan application.

Step-by-Step Application Process

- Create a Shopify account and ensure your business meets the eligibility criteria.

- Access the Capital page on your Shopify account dashboard and click on "Apply Now".

- Fill out the application form with details about your business, revenue, and desired loan amount.

- Submit any required documentation, such as bank statements or sales reports, to support your application.

- Wait for Shopify to review your application and provide a decision.

- If approved, review the loan offer, including terms and repayment schedule, and accept it to receive the funds.

Documentation and Information Required

- Basic business information such as legal business name, address, and contact details.

- Financial details including revenue, profit margin, and cash flow projections.

- Bank statements or sales reports to verify your business performance.

- Details about the intended use of the loan and how it will benefit your business.

- Any additional information requested by Shopify to support your application.

Decision Timeframe

Once you have submitted your application and all required documentation, Shopify typically takes a few business days to review and provide a decision. The exact timeframe may vary based on the complexity of your application and the volume of applications being processed.

Case Studies and Success Stories

In this section, we will explore real-life examples of small businesses that have benefited from Shopify Capital Loan, illustrating how this funding option has helped them grow and succeed.

Case Study 1: Boutique Clothing Store

A boutique clothing store owner was looking to expand her inventory and launch an online store to reach a wider audience. With the help of a Shopify Capital Loan, she was able to purchase new stock, invest in marketing, and set up an e-commerce website.

As a result, her sales increased by 50% within the first year, and she was able to hire additional staff to manage the growing demand.

Case Study 2: Handmade Jewelry Maker

A small business owner specializing in handmade jewelry needed funds to purchase raw materials in bulk and attend a trade show to showcase her products. By securing a Shopify Capital Loan, she was able to take advantage of bulk discounts, expand her product line, and secure new wholesale accounts.

This led to a 30% increase in revenue and a significant growth in her customer base.

Case Study 3: Specialty Food Truck

The owner of a specialty food truck wanted to upgrade his equipment and expand his menu offerings to cater to a larger audience. With the support of Shopify Capital Loan, he was able to purchase a new food truck, invest in kitchen upgrades, and launch a marketing campaign to promote his business.

This resulted in a 40% increase in sales and allowed him to participate in large events and festivals, further boosting his brand recognition.

Closing Summary

In conclusion, the discussion surrounding Is Shopify Capital Loan Right for Small Businesses? offers a nuanced perspective on the financial landscape for small businesses. By weighing the advantages and drawbacks, small business owners can navigate the realm of financing with confidence and clarity.

Frequently Asked Questions

Is there a minimum credit score required to qualify for a Shopify Capital Loan?

Shopify does not disclose a specific credit score requirement, but they consider various factors beyond credit score when evaluating applications.

Can I use a Shopify Capital Loan for any business expenses?

Yes, you can use the funds from a Shopify Capital Loan for a wide range of business expenses, such as inventory purchases, marketing campaigns, or equipment upgrades.

What happens if I am unable to repay a Shopify Capital Loan on time?

If you are unable to make timely repayments, Shopify may charge additional fees or take other actions to recover the outstanding amount.

Is collateral required to secure a Shopify Capital Loan?

No, Shopify Capital Loans are typically unsecured, meaning you do not need to provide collateral to secure the funding.