Progressive Commercial Auto Insurance: Benefits & Drawbacks sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

In the following paragraphs, we will delve into the coverage options, advantages of bundling policies, discounts, drawbacks, claims process, and pricing impacts of Progressive Commercial Auto Insurance.

Benefits of Progressive Commercial Auto Insurance

When it comes to Progressive Commercial Auto Insurance, policyholders can enjoy a range of benefits tailored to meet the specific needs of commercial vehicles.

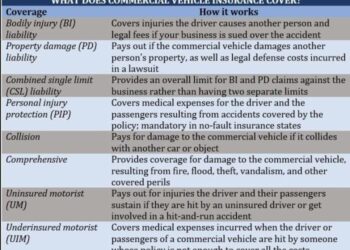

Coverage Options for Commercial Vehicles

- Progressive offers comprehensive coverage options for commercial vehicles, including liability insurance, collision coverage, and uninsured motorist coverage.

- Policyholders can also opt for additional coverage such as roadside assistance, rental reimbursement, and custom equipment coverage.

Advantages of Bundling Commercial Auto Insurance

- By bundling commercial auto insurance with other policies such as general liability or property insurance, businesses can often save money on premiums.

- Consolidating policies with Progressive can streamline the insurance process and make it easier to manage multiple policies under one provider.

Progressive’s Discounts and Rewards Programs

- Progressive offers various discounts and rewards programs for commercial policyholders, such as safe driver discounts, multi-policy discounts, and pay-in-full discounts.

- Policyholders can also earn rewards for safe driving behavior through programs like Snapshot, which tracks driving habits and offers potential discounts based on performance.

Drawbacks of Progressive Commercial Auto Insurance

When considering Progressive Commercial Auto Insurance, it is important to be aware of certain drawbacks that policyholders may encounter. These limitations or exclusions in coverage, potential issues with the claims process, and the impact of pricing or rate increases over time are all factors to consider before making a decision.

Limitations or Exclusions in Coverage

- Progressive Commercial Auto Insurance may have limitations on coverage for certain types of vehicles, such as high-risk or specialized vehicles.

- Exclusions in coverage may apply to specific situations, such as using the vehicle for non-business purposes or engaging in illegal activities while driving.

- Policyholders should carefully review the policy details to understand the extent of coverage and any restrictions that may apply.

Potential Drawbacks of Progressive’s Claims Process

- The claims process for Progressive Commercial Auto Insurance may be complex and time-consuming, leading to delays in receiving compensation for damages or losses.

- Policyholders may encounter challenges in proving the extent of damages or liability, which could result in disputes or disagreements with the insurance company.

- Communication issues or delays in processing claims could also impact the overall experience for policyholders filing a claim.

Impact of Pricing or Rate Increases Over Time

- Progressive Commercial Auto Insurance rates may increase over time due to various factors, such as changes in driving record, claims history, or market conditions.

- Policyholders may face higher premiums or additional fees as a result of rate increases, which could impact the affordability of maintaining coverage.

- Comparing rates regularly and exploring options for discounts or cost-saving measures may help mitigate the impact of pricing changes on policyholders.

Summary

In conclusion, the discussion on Progressive Commercial Auto Insurance: Benefits & Drawbacks highlights the importance of understanding both the pros and cons to make informed decisions. It's a dynamic landscape that requires careful consideration and evaluation.

User Queries

What coverage options are available for commercial vehicles?

Progressive offers a range of coverage options for commercial vehicles, including liability, comprehensive, collision, and more.

How do Progressive's discounts and rewards programs benefit commercial policyholders?

Progressive's discounts and rewards programs can help commercial policyholders save money and earn incentives for safe driving practices.

Are there any limitations or exclusions in Progressive Commercial Auto Insurance coverage?

While Progressive offers comprehensive coverage, there may be limitations or exclusions based on the specific policy details. It's important to review the policy carefully.

How may pricing or rate increases affect policyholders over time with Progressive?

Over time, pricing or rate increases by Progressive may impact policyholders by potentially raising their insurance costs. It's essential to stay informed about any changes.