Dive into the world of car insurance quotes with our guide on how to secure the lowest annual premiums. From understanding the basics to navigating the process, we've got you covered.

Understanding Car Insurance Quotes

When shopping for car insurance, it's essential to understand how car insurance quotes work and what factors influence the premiums you are quoted. By comparing different coverage options and shopping around for quotes, you can find the best deal that suits your needs and budget.

Factors Influencing Car Insurance Premiums

- Your driving record: A clean driving record with no accidents or traffic violations can lead to lower premiums.

- Type of coverage: The amount and type of coverage you choose will affect your premium. Comprehensive coverage will cost more than basic liability coverage.

- Your car's make and model: The cost to repair or replace your vehicle will impact your premium. More expensive cars typically have higher premiums.

- Location: Where you live can impact your premium due to factors like crime rates and traffic congestion.

- Age and gender: Younger drivers and males tend to pay higher premiums due to statistical data on accident rates.

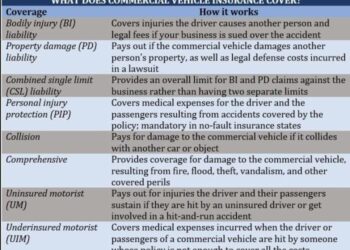

Types of Coverage Options

- Liability coverage: Covers damages to other people or property in an accident where you are at fault.

- Collision coverage: Covers damages to your own vehicle in a collision with another vehicle or object.

- Comprehensive coverage: Covers damages to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you are in an accident with a driver who has little or no insurance.

Importance of Shopping Around

It is crucial to shop around for car insurance quotes from multiple providers to ensure you are getting the best deal. By comparing quotes, you can find the right coverage at the lowest price, saving you money in the long run.

Researching Insurance Providers

When looking for the best car insurance coverage, it is crucial to research and evaluate different insurance providers to ensure you are getting the most competitive rates and reliable service.Checking the financial stability and customer reviews of insurance companies can give you valuable insights into their reputation and ability to meet their financial obligations in times of need.

It is essential to choose a reputable insurance provider that has a track record of excellent customer service and prompt claims processing.

Top Insurance Providers for Competitive Rates

- GEICO

- Progressive

- State Farm

- Allstate

Significance of Financial Stability and Customer Reviews

- Financial stability ensures that the insurance company can fulfill its claims obligations.

- Customer reviews give you insights into the quality of service and claims handling.

- Choosing a financially stable and well-reviewed insurance provider can give you peace of mind and assurance in case of accidents or emergencies.

Benefits of Choosing a Reputable Insurance Provider

- Quick and efficient claims processing.

- 24/7 customer support for assistance anytime you need it.

- Potential discounts and rewards for safe driving habits.

- Access to a network of trusted repair shops for quality repairs.

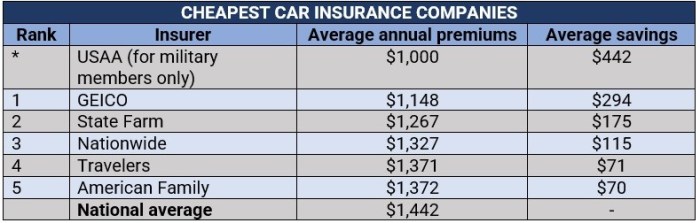

Comparing Annual Premiums

When it comes to purchasing car insurance, comparing annual premiums from different insurance companies is crucial to finding the best coverage at the lowest cost. By analyzing quotes and understanding the differences in coverage and cost, you can make an informed decision that suits your needs and budget.

Table of Annual Premiums Comparison

| Insurance Company | Annual Premium | Coverage Details |

|---|---|---|

| Company A | $800 | Full coverage with roadside assistance |

| Company B | $900 | Basic coverage with no additional benefits |

| Company C | $700 | Comprehensive coverage with rental car reimbursement |

Highlighting the differences in coverage and cost between various insurance quotes can help you choose the best option tailored to your needs.

Negotiating for Lower Annual Premiums

- Ask for discounts: Inquire about available discounts such as safe driver, multi-policy, or good student discounts that can lower your premium.

- Bundle policies: Consider bundling your car insurance with other policies like home or renters insurance to save on overall costs.

- Review coverage limits: Adjusting your coverage limits or deductibles can impact your premium, so ensure you have the right amount of coverage for your situation.

Leveraging Quotes for the Lowest Premium

- Compare quotes: Don't settle for the first quote you receive. Compare multiple quotes to find the most competitive offer.

- Use quotes as leverage: Once you have multiple quotes, use them to negotiate with your preferred insurance company for a lower premium.

- Ask for customization: Tailor your coverage to your needs and budget by customizing your policy based on the quotes you've received.

Navigating the Insurance Quote Process

When it comes to obtaining and comparing car insurance quotes, there are several key steps to keep in mind. By following a systematic approach, you can ensure that you are getting the best coverage at the most competitive rates. Here is a detailed guide to help you navigate the insurance quote process effectively.

Steps for Obtaining and Comparing Car Insurance Quotes

- Research Insurance Providers: Start by researching reputable insurance companies that offer car insurance in your area. Look for companies with good customer reviews and a strong financial standing.

- Request Quotes: Reach out to multiple insurance providers to request quotes based on your specific needs and driving history. Make sure to provide accurate information to receive the most accurate quotes.

- Compare Coverage Options: Review the coverage options included in each quote, such as liability, comprehensive, collision, and personal injury protection. Consider your individual needs and budget when comparing these options.

- Analyze Premiums and Deductibles: Pay close attention to the annual premiums and deductibles Artikeld in each quote. Compare these costs across different providers to find the most affordable option that still offers adequate coverage.

Checklist for Reviewing and Analyzing Insurance Quotes

- Ensure Accuracy: Double-check that all the information provided in the quotes is accurate and up-to-date.

- Review Coverage Limits: Make sure the coverage limits meet your state's minimum requirements and any additional coverage you may need.

- Consider Discounts: Inquire about any available discounts, such as multi-policy, safe driver, or good student discounts, to lower your premium.

- Assess Customer Service: Research the insurance provider's customer service reputation to ensure you will receive quality support when needed.

Customizing Coverage Options to Fit Individual Needs

- Adjust Coverage Limits: Customize your coverage limits based on your assets and financial situation to ensure you are adequately protected in case of an accident.

- Add Optional Coverage: Consider adding optional coverage such as roadside assistance, rental car reimbursement, or gap insurance to enhance your policy.

- Review Deductibles: Choose deductibles that align with your budget and risk tolerance, balancing lower premiums with out-of-pocket costs in the event of a claim.

Common Pitfalls to Avoid When Shopping for Car Insurance Quotes

- Choosing the Cheapest Option: Don't automatically choose the cheapest quote without considering the coverage and customer service quality.

- Overlooking Discounts: Make sure to ask about available discounts to maximize your savings on premiums.

- Ignoring Policy Details: Read through the policy details carefully to understand what is covered and any exclusions that may apply.

Final Thoughts

In conclusion, shopping for car insurance quotes can save you money in the long run. By comparing options and leveraging quotes, you can find the best deal tailored to your needs. Stay informed and drive with confidence.

Question Bank

How are car insurance quotes calculated?

Car insurance quotes are determined based on factors such as driving record, age, type of vehicle, and coverage options.

What should I consider when researching insurance providers?

Look into the company's reputation, customer reviews, financial stability, and competitive rates.

How can I negotiate for lower annual premiums?

You can negotiate by comparing quotes, highlighting differences, and discussing potential discounts with the insurance provider.

What steps are involved in obtaining and comparing car insurance quotes?

Steps include gathering information, requesting quotes, analyzing coverage and costs, and customizing options to fit your needs.

What are common pitfalls to avoid when shopping for car insurance quotes?

Avoid pitfalls like not comparing enough quotes, overlooking coverage details, and failing to inquire about discounts.