Exploring the nuances of Commercial Auto Policy Renewal Guide for Fleet Owners, this introduction aims to provide a detailed yet accessible look into the intricacies of policy renewal for fleet owners.

As we delve deeper into the realm of commercial auto policy renewals, we aim to shed light on key aspects that fleet owners should be aware of to navigate this process effectively.

Understanding Commercial Auto Policy Renewal

When it comes to commercial auto policy renewal for fleet owners, there are several key components to consider. Understanding the renewal process, the importance of timely renewal, and the implications for fleet operations are crucial aspects to keep in mind.

Key Components of Commercial Auto Policy Renewal

- Policy Review: Fleet owners should carefully review their current policy to ensure it still meets their needs and covers all necessary aspects.

- Premium Evaluation: Evaluating the premium amount and comparing it to other available options can help fleet owners make cost-effective decisions.

- Policy Updates: Any changes in the fleet size, drivers, or vehicles should be updated in the policy to ensure accurate coverage.

- Claims History: Understanding the fleet's claims history can impact the renewal premium and coverage options.

Typical Renewal Process for Commercial Auto Policies

- Renewal Notice: Insurance companies typically send a renewal notice before the expiration date of the current policy.

- Review Options: Fleet owners should review the renewal options provided by the insurance company and consider any changes needed.

- Payment: Making the renewal payment on time is crucial to avoid any lapses in coverage.

- Confirmation: Once the payment is processed, fleet owners should receive confirmation of the renewed policy.

Importance of Timely Policy Renewal

- Continuous Coverage: Timely renewal ensures that there are no gaps in coverage, which can be detrimental in case of accidents or incidents.

- Compliance: Renewing the policy on time helps fleet owners stay compliant with legal requirements and regulations.

- Operational Stability: A renewed policy provides stability for fleet operations and allows for seamless business continuity.

Reviewing Policy Coverage

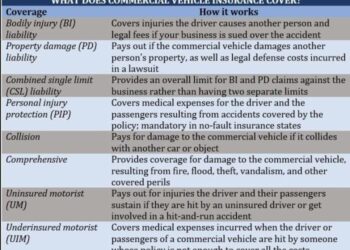

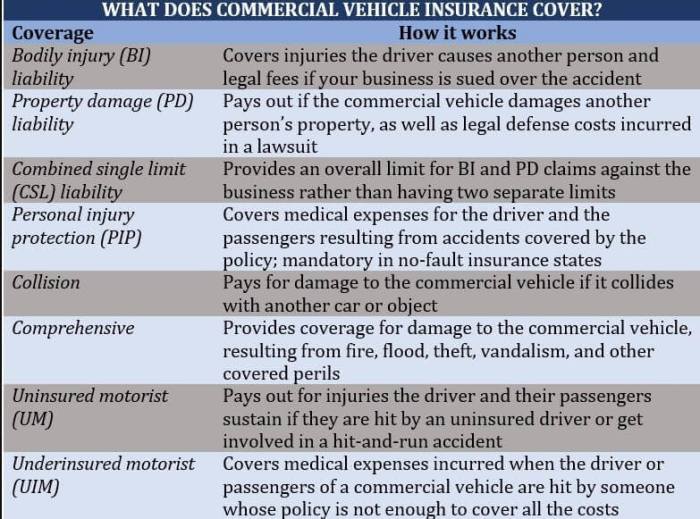

When it comes to renewing a commercial auto policy for fleet owners, understanding the different coverage options available is crucial. This helps ensure that your fleet is adequately protected while also managing costs effectively. Let's delve into the types of coverage options, compare different coverage levels, and explore how changes in coverage can impact premiums during renewal.

Types of Coverage Options

- Liability Coverage: This protects against bodily injury and property damage caused by your fleet vehicles in an at-fault accident.

- Collision Coverage: Covers the cost of repairing or replacing your vehicles if they are damaged in a collision.

- Comprehensive Coverage: Provides coverage for non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if your fleet is involved in an accident with a driver who has insufficient or no insurance.

Comparing Coverage Levels

- Basic Coverage: Offers the minimum required coverage by law, but may leave you vulnerable to certain risks.

- Standard Coverage: Provides a balance between protection and cost, offering more comprehensive coverage than the basic level.

- Enhanced Coverage: Includes additional protections such as higher liability limits, rental reimbursement, or roadside assistance.

Impact on Premiums

- Increasing coverage levels typically result in higher premiums due to the increased protection offered.

- Adding or removing coverage options can also impact premiums, as each coverage type contributes to the overall cost.

- Factors such as the size of your fleet, driving history, and the types of vehicles can also influence premium changes during renewal.

Evaluating Fleet Needs

When it comes to renewing your commercial auto policy as a fleet owner, evaluating your fleet needs is a crucial step in ensuring you have the right coverage in place. By assessing your specific operational requirements, you can make informed decisions about the level of coverage needed for your fleet.

Factors to Consider

- Number of Vehicles: Evaluate the size of your fleet and consider if you need to add or remove vehicles from your policy.

- Types of Vehicles: Determine the types of vehicles in your fleet and whether they require specialized coverage based on their use.

- Usage Patterns: Analyze how your vehicles are used, such as long-distance hauling or local deliveries, to adjust your coverage accordingly.

- Driver Qualifications: Review the qualifications and driving records of your drivers to ensure they meet insurance requirements.

- Risk Assessment: Identify potential risks specific to your fleet operations, such as accident-prone routes or hazardous cargo, to address in your policy.

By carefully evaluating your fleet needs, you can tailor your policy to provide adequate coverage where it matters most.

Negotiating Renewal Terms

When it comes to negotiating better terms during a commercial auto policy renewal, fleet owners need to be strategic and prepared. By understanding common negotiation points and leveraging fleet data, they can position themselves for a more favorable outcome.

Leveraging Fleet Data in Negotiations

One effective strategy for negotiating renewal terms is to use fleet data and performance metrics to your advantage

- Provide detailed reports on accident frequency, severity, and causes within your fleet.

- Showcase any safety initiatives or training programs implemented to reduce accidents.

- Highlight any improvements in driver behavior or performance based on data analysis.

Common Negotiation Points and Tactics

Understanding the key negotiation points and tactics can help fleet owners navigate discussions with insurers more effectively. By being aware of these common areas of negotiation, you can proactively address them and work towards a mutually beneficial agreement.

- Discuss premium rates and explore options for discounts based on fleet performance.

- Review coverage limits and adjust as needed to align with the current needs of your operation.

- Negotiate deductibles and consider increasing them to lower premium costs, if feasible.

Remember to approach negotiations with a collaborative mindset, seeking solutions that benefit both parties.

Understanding Premium Adjustments

Insurance premiums for commercial auto policies are calculated based on various factors that determine the level of risk associated with insuring a fleet. Premium adjustments during policy renewal are influenced by several key elements that can either increase or decrease the overall cost for fleet owners.

Factors Affecting Premium Changes

- Claims History: A history of frequent or severe claims can lead to an increase in premiums, as it indicates a higher risk for the insurance provider.

- Vehicle Type and Usage: The type of vehicles in the fleet and how they are used can impact premium adjustments. For example, vehicles used for long-haul transportation may have higher premiums compared to those used for local deliveries.

- Driver Records: The driving records of the drivers in the fleet can also influence premium changes. Drivers with a history of accidents or traffic violations may result in higher premiums.

- Policy Limits and Deductibles: Adjusting policy limits and deductibles can affect premium costs. Increasing coverage limits or lowering deductibles may lead to higher premiums, while reducing coverage limits or increasing deductibles can result in lower premiums.

Examples of Premium Adjustments

For example, if a fleet owner has had a clean claims history and implemented safety measures such as driver training programs, they may see a decrease in premiums during policy renewal. Conversely, if there have been multiple at-fault accidents involving the fleet, premiums are likely to increase.

Another scenario where premiums may increase is if the vehicles in the fleet have depreciated in value, leading to higher repair or replacement costs in the event of an accident.

Compliance and Regulatory Considerations

When it comes to policy renewal for commercial auto insurance, compliance with regulations is crucial for fleet owners. Failure to meet regulatory requirements can result in fines, penalties, or even the suspension of operations. It is essential to understand and adhere to the key regulatory considerations during the renewal process.

Key Regulatory Requirements

- Ensure that all drivers have the necessary licenses and qualifications to operate commercial vehicles. This includes verifying that drivers have valid commercial driver's licenses (CDL) and any additional endorsements required for the type of vehicles they will be operating.

- Comply with hours of service regulations to prevent driver fatigue and ensure road safety. Monitor and record drivers' hours accurately to avoid violations.

- Maintain proper vehicle registration and ensure that all vehicles in the fleet meet safety standards and pass required inspections. Any non-compliance with vehicle regulations can lead to significant consequences.

- Stay up to date with changes in insurance requirements mandated by regulatory bodies. Make sure your commercial auto policy meets the minimum coverage limits and types of coverage required by law.

Outcome Summary

In conclusion, the Commercial Auto Policy Renewal Guide for Fleet Owners serves as a valuable resource for understanding the complexities of policy renewals and ensuring fleet operations run smoothly.

Query Resolution

What are the key components of a commercial auto policy renewal for fleet owners?

The key components include evaluating coverage needs, negotiating renewal terms, understanding premium adjustments, and ensuring compliance with regulations.

How can fleet owners leverage fleet data and performance metrics during policy renewal negotiations?

Fleet owners can use fleet data to showcase their operational efficiency, safety records, and risk management strategies, which can help in negotiating better terms and premiums.

What factors can influence premium changes for fleet owners during policy renewal?

Factors such as claims history, vehicle types, driver records, and industry regulations can significantly impact premium adjustments during policy renewal.