When it comes to saving big on Geico commercial auto insurance renewals, there are key strategies that can help businesses cut costs effectively. From negotiating discounts to leveraging technology, this guide dives into the nuances of renewing your policy while keeping your budget in check.

In the following sections, we will explore factors affecting renewal costs, strategies for negotiating discounts, utilizing technology to lower insurance costs, and bundling options for additional savings. Let's uncover the secrets to maximizing your savings on Geico commercial auto insurance renewals.

Factors Affecting Geico Commercial Auto Insurance Renewal Costs

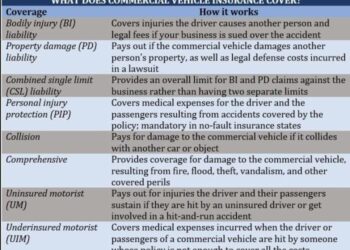

When it comes to renewing your Geico commercial auto insurance, several key factors can impact the cost of your premiums. Understanding these factors can help you find ways to save on your renewal costs.

Business Size

The size of your business can play a significant role in determining your renewal costs. Larger businesses with more vehicles may qualify for bulk discounts or special rates, while smaller businesses may pay higher premiums due to a lack of volume discounts.

Location

Your business location can also affect your Geico commercial auto insurance renewal costs. Urban areas with higher traffic congestion and crime rates may result in higher premiums compared to rural areas with lower risks of accidents and theft.

Driving History

Your driving history, including past accidents, tickets, and claims, can impact your renewal costs. Safe drivers with a clean record are likely to receive lower premiums, while those with a history of accidents may face higher rates.

Vehicle Type

The type of vehicles you have insured under your Geico commercial auto policy can also influence your renewal costs. Vehicles with advanced safety features may qualify for discounts, while older vehicles or high-risk models may lead to higher premiums.By considering these factors and making informed decisions, you can potentially save big on your Geico commercial auto insurance renewal costs.

Strategies for Negotiating Discounts with Geico

When it comes to renewing your Geico commercial auto insurance policy, negotiating discounts can help you save money. Here are some effective strategies to consider:

1. Bundle Policies

One way to secure a discount with Geico is by bundling your commercial auto insurance policy with other types of insurance, such as business liability or property insurance. By combining multiple policies, you may be eligible for a multi-policy discount.

2. Maintain a Good Driving Record

Having a clean driving record can also work in your favor when negotiating discounts. Geico rewards safe drivers with lower premiums, so make sure to drive safely and avoid accidents or traffic violations.

3. Inquire About Available Discounts

Don't hesitate to ask your Geico representative about any available discounts that you may qualify for. This could include discounts for safety features on your vehicles, completing a defensive driving course, or being a loyal customer.

4. Review Your Coverage Needs

Review your current coverage needs with Geico to see if there are any adjustments you can make to lower your premium. You may find that you are over-insured in certain areas or that you can increase your deductible to reduce your costs.

5. Negotiate Based on Market Rates

Do your research on market rates for commercial auto insurance and use this information to negotiate with Geico. If you find a better offer from a competitor, don't hesitate to bring it up during your negotiations to see if Geico can match or beat the offer.

Utilizing Technology to Lower Geico Commercial Auto Insurance Costs

In today's digital age, businesses can leverage technology to reduce Geico commercial auto insurance costs significantly. By implementing solutions like telematics and GPS tracking, companies can not only improve driver safety but also potentially lower insurance premiums at renewal.

Telematics and GPS Tracking

- Telematics systems collect data on driving behavior, such as speed, braking, and distance traveled, providing insurers with valuable insights into risk levels.

- GPS tracking enables businesses to monitor vehicle locations in real-time, helping prevent theft and improve route efficiency.

- By implementing these technologies, companies can demonstrate safe driving practices to insurers, potentially leading to discounts on insurance premiums.

Driver Monitoring Systems

- Driver monitoring systems utilize technology to track and analyze driver behavior, such as speeding or harsh braking, allowing businesses to identify risky habits and address them proactively.

- Insurers may offer discounts to businesses that use driver monitoring systems, as they can help reduce the likelihood of accidents and claims.

- By investing in these systems, businesses can not only improve safety but also potentially lower insurance costs over time.

Bundling Options for Additional Savings

Bundling commercial auto insurance with other Geico policies can provide various advantages for policyholders. By combining multiple insurance policies, customers can often access significant discounts on their renewal premiums. This cost-saving strategy allows individuals and businesses to streamline their insurance needs and simplify the renewal process.

Here are some tips on how to effectively bundle insurance policies to maximize cost savings:

Maximizing Discounts through Bundling

When bundling insurance policies, it's essential to consider the types of coverage you need and how they can complement each other. By combining commercial auto insurance with other Geico policies such as home insurance, renters insurance, or business insurance, you can qualify for multi-policy discounts.

These discounts can result in lower overall premiums, ultimately saving you money in the long run.

Additionally, bundling policies with the same insurance provider can simplify your administrative tasks and make it easier to manage your coverage. With all your policies under one roof, you can enjoy a seamless renewal process and have a single point of contact for any insurance-related inquiries or claims.

To maximize cost savings through bundling, it's important to review your insurance needs regularly and adjust your coverage as necessary. By evaluating your policies and bundling options annually, you can ensure that you're getting the best value for your insurance premiums while meeting your evolving coverage needs.

Concluding Remarks

As we conclude our discussion on saving big on Geico commercial auto insurance renewals, remember that being proactive and informed can lead to significant cost savings. By understanding the factors that influence renewal costs and employing effective negotiation tactics, businesses can secure the best deals and optimize their insurance coverage.

Take charge of your insurance renewal process and watch your savings grow.

Frequently Asked Questions

What factors can impact Geico commercial auto insurance renewal costs?

Factors such as business size, location, driving history, and vehicle type can all influence renewal costs. By understanding how these factors affect premiums, businesses can make informed decisions to save money on their insurance.

How can businesses negotiate discounts with Geico for auto insurance renewals?

Effective negotiation tactics, maintaining a good relationship with Geico, and exploring different discount options are key strategies for securing discounts on insurance renewals. By being proactive and prepared, businesses can increase their chances of getting the best deals.

What role does technology play in lowering Geico commercial auto insurance costs?

Technologies like telematics and GPS tracking can help reduce insurance premiums by providing data that demonstrates safe driving habits. Implementing these solutions can lead to cost savings at renewal and potentially lower insurance rates for businesses.

Are there advantages to bundling commercial auto insurance with other Geico policies?

Bundling multiple policies with Geico can result in significant discounts on renewal premiums. By combining commercial auto insurance with other policies, businesses can maximize their cost savings and simplify their insurance coverage under one provider.