Embarking on the journey of finding the right car insurance can be daunting. With the plethora of options available online, it's essential to navigate through the process effectively. This article delves into the world of online tools designed to make shopping for car insurance a breeze.

Researching Car Insurance Options

When looking for car insurance online, it's crucial to research your options thoroughly to find the best coverage for your needs at a competitive price. Here are some strategies to help you navigate the process effectively.

Comparing Coverage, Premiums, and Deductibles

Before making a decision, compare the coverage, premiums, and deductibles offered by different insurance companies. This will help you understand what each policy includes and how much you will have to pay out of pocket in case of an accident or claim.

- Take note of the types of coverage each policy offers, such as liability, collision, comprehensive, and uninsured/underinsured motorist.

- Compare the premiums for each policy to ensure you are getting a competitive rate.

- Consider the deductibles for each policy and how they will impact your out-of-pocket expenses.

Identifying Reputable Insurance Companies and Reading Customer Reviews

It's essential to choose a reputable insurance company that will provide excellent customer service and support when you need it the most. Here are some tips for identifying trustworthy insurers:

- Check the financial strength ratings of insurance companies from independent rating agencies like A.M. Best, Standard & Poor's, or Moody's.

- Look for customer reviews and ratings online to see what others have to say about their experiences with a particular insurer.

- Consider the number of complaints filed against an insurance company with the National Association of Insurance Commissioners (NAIC) to gauge their customer satisfaction levels.

Utilizing Comparison Websites

When it comes to shopping for car insurance, comparison websites can be incredibly useful tools. These platforms allow you to easily compare multiple insurance quotes from different providers in one place, saving you time and effort in finding the best coverage for your needs.

Popular Online Tools for Comparing Car Insurance Quotes

- Insurify: Insurify is a popular comparison website that allows you to compare quotes from top insurance companies quickly and easily.

- The Zebra: The Zebra is another well-known platform that provides personalized car insurance quotes based on your driving profile.

- Compare.com: With Compare.com, you can compare quotes from multiple insurance carriers and choose the one that fits your budget and coverage requirements.

Benefits of Using Comparison Websites

- Save Time: Instead of visiting multiple insurance websites individually, you can compare quotes side by side on one platform.

- Save Money: By comparing different quotes, you can find the most affordable option that still offers the coverage you need.

- Easy Comparison: Comparison websites provide a clear breakdown of each quote, making it easier to understand the differences in coverage and pricing.

- Customized Options: Many comparison websites allow you to input your specific information and preferences to receive personalized quotes tailored to your needs.

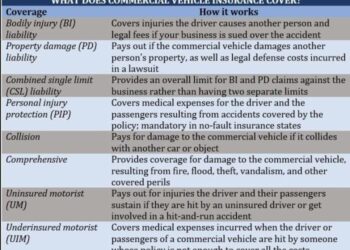

Understanding Coverage Types

When shopping for car insurance, it's essential to understand the different types of coverage available to make an informed decision that suits your needs and budget.

Car insurance coverage can vary depending on the provider and policy, but some common types include:

Liability Coverage

- Liability coverage helps pay for injuries and property damage that you may cause to others in an accident where you are at fault.

- It is usually required by law and helps protect you financially in case of a lawsuit.

- Examples: If you rear-end another vehicle and it's determined to be your fault, liability coverage can help cover the cost of repairs to the other driver's car.

Comprehensive Coverage

- Comprehensive coverage helps pay for damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters.

- It provides added protection for your car in various non-collision scenarios.

- Examples: If your car is stolen or damaged by a hailstorm, comprehensive coverage can help cover the cost of repairs or replacement.

Collision Coverage

- Collision coverage helps pay for damage to your vehicle in a collision with another vehicle or object.

- It can be useful if you are at fault in an accident or if your car is damaged by hitting an object like a tree or pole.

- Examples: If you accidentally hit a guardrail and damage your car, collision coverage can help cover the repair costs.

Advantages and Disadvantages

| Coverage Type | Advantages | Disadvantages |

|---|---|---|

| Liability | Required by law, protects against lawsuits | May not cover damage to your vehicle |

| Comprehensive | Covers a wide range of non-collision incidents | Can be more expensive than basic coverage |

| Collision | Protects against collision damage | May not cover all repair costs |

Using Online Calculators

Online calculators are valuable tools that can help individuals determine appropriate coverage levels for their car insurance needs. These calculators work by taking into account various factors such as age, driving history, type of vehicle, and desired coverage options. Users typically need to input information such as their zip code, age, gender, driving record, and the make and model of their vehicle to get an accurate estimate.

Importance of Accurately Estimating Coverage Needs

- Using online calculators can help prevent underinsuring, which may leave individuals vulnerable in the event of an accident or other unexpected situations.

- On the other hand, overpaying for coverage that is not necessary can strain finances unnecessarily. Calculators can provide a tailored estimate based on individual needs.

- By inputting accurate information into these calculators, users can ensure they are getting the right amount of coverage at a price that fits their budget.

Considering Discounts and Bundling

When shopping for car insurance, it's important to consider the various discounts offered by insurance companies and the potential cost savings that can come from bundling insurance policies. By understanding these options, you can maximize your savings and get the best coverage for your needs.

Common Discounts Offered

- Safe driver discount: Insurance companies often offer discounts to drivers with a clean driving record and no accidents or traffic violations.

- Multi-policy discount: If you have multiple insurance policies with the same company, such as auto and home insurance, you may qualify for a discount on both policies.

- Good student discount: Students with good grades may be eligible for a discount on their car insurance premiums.

Bundling Insurance Policies

When you bundle insurance policies, such as combining your auto and home insurance with the same company, you can often save money on both policies. This is because insurance companies offer discounts for customers who purchase multiple policies from them.

Maximizing Discounts and Bundling Opportunities

- Shop around: Compare quotes from multiple insurance companies to find the best discounts and bundling options.

- Ask about available discounts: When getting quotes, be sure to ask about any discounts you may qualify for, such as safe driver or multi-policy discounts.

- Consider your coverage needs: While discounts are important, make sure you're getting the coverage you need at a price you can afford.

Navigating the Online Application Process

When filling out an online car insurance application, it is essential to provide accurate information to ensure you receive the right coverage for your needs. Here is a step-by-step guide on how to navigate the online application process effectively.

Information Required During the Application Process

- Personal Information: You will need to provide details such as your name, address, contact information, date of birth, and driver's license number.

- Vehicle Information: Information about the vehicle you want to insure, including make, model, year, VIN number, and mileage.

- Driving History: Details about your driving record, including accidents, tickets, and any previous claims.

- Coverage Preferences: Select the type of coverage you want, such as liability, collision, comprehensive, and any additional options.

- Payment Information: Provide details for payment, such as bank account or credit card information.

Common Mistakes to Avoid When Completing an Online Car Insurance Application

- Providing Inaccurate Information: Make sure all the information you provide is accurate to prevent any issues with your policy later on.

- Skipping Coverage Options: Take the time to review all coverage options available and select the ones that best suit your needs.

- Not Reviewing the Application: Before submitting, review the application to ensure all information is correct and complete.

- Ignoring Discounts: Be sure to explore any discounts or bundling options that could help you save on your car insurance premium.

- Not Asking Questions: If you are unsure about any part of the application, don't hesitate to reach out to the insurance company for clarification.

Last Recap

In conclusion, leveraging online tools to shop for car insurance can streamline the process and help you find the best coverage for your needs. With the right tools at your disposal, you can make informed decisions and secure your vehicle with confidence.

FAQ Corner

How important is it to compare coverage, premiums, and deductibles when researching car insurance options?

It's crucial to compare these aspects to ensure you get the best value for your money and adequate coverage for your vehicle.

What are some common discounts offered by insurance companies?

Common discounts include safe driver discounts, multi-policy discounts, and good student discounts, among others.

What information is typically required during the online car insurance application process?

Typically, you'll need to provide personal information, details about your vehicle, driving history, and desired coverage levels.