Exploring the vital role of insurance in protecting remote work businesses opens up a world of possibilities and challenges. From shielding against unforeseen risks to ensuring financial stability, the realm of insurance in remote setups is vast and intriguing.

As we delve deeper, we unravel the layers of protection that insurance offers in the dynamic landscape of remote work environments.

Importance of Insurance for Remote Work Businesses

Insurance plays a crucial role in safeguarding remote work businesses from various risks and uncertainties. It provides financial protection and peace of mind to business owners operating in a virtual environment.

Specific Risks Covered by Insurance

- Cybersecurity Threats: Insurance can cover losses resulting from data breaches, hacking attacks, or other cyber threats that may compromise sensitive information.

- Professional Liability: Remote work businesses can be protected against claims of errors, omissions, or negligence in delivering services to clients.

- Equipment Damage: Insurance can help cover the costs of repairing or replacing essential equipment like laptops, smartphones, or other devices used for remote work.

- Business Interruption: In case of unforeseen events such as natural disasters or power outages, insurance can provide coverage for lost income and ongoing expenses.

Differences in Insurance Plans for Remote Businesses

Insurance plans tailored for remote work businesses differ from traditional coverage by addressing the specific needs and challenges of operating in a virtual workspace. These plans may include:

- Remote Cybersecurity Coverage: Specialized insurance for remote businesses that focuses on protecting against cyber threats unique to virtual operations.

- Virtual Communication Coverage: Coverage for liabilities arising from miscommunication or misunderstandings in remote work settings.

- Remote Equipment Protection: Enhanced coverage for remote work equipment, including coverage for loss or damage outside the traditional office environment.

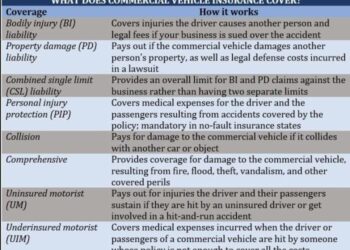

Types of Insurance Policies for Remote Work Businesses

Insurance is crucial for remote work businesses to protect themselves from various risks. There are several types of insurance policies specifically designed to safeguard remote businesses, including general liability insurance, cyber liability insurance, and business interruption insurance. Each type of insurance serves a different purpose and offers unique protections for remote work businesses.

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims. For remote work businesses, this type of insurance can protect against lawsuits related to accidents or injuries that occur during work activities. For example, if a client visits a remote worker's home office and gets injured, general liability insurance can cover the medical expenses and legal fees associated with the incident.

Cyber Liability Insurance

Cyber liability insurance is essential for remote work businesses that rely heavily on technology and store sensitive data online. This type of insurance helps cover the costs associated with data breaches, cyber attacks, and other cyber risks. For instance, if a remote worker's computer is hacked, and confidential client information is compromised, cyber liability insurance can help cover the costs of notifying affected parties, credit monitoring services, and legal expenses.

Business Interruption Insurance

Business interruption insurance is designed to protect remote work businesses from financial losses caused by unexpected disruptions to their operations. This type of insurance can cover lost income, ongoing expenses, and temporary relocation costs in the event of a covered incident, such as a natural disaster or equipment failure.

For example, if a remote worker's internet connection goes down for an extended period, business interruption insurance can help compensate for the lost productivity and revenue during that time.

Considerations for Choosing Insurance Coverage

When it comes to choosing insurance coverage for remote work businesses, there are several key factors to consider. It is crucial to assess the unique needs and vulnerabilities of remote setups to ensure adequate protection

Assessing Unique Needs and Vulnerabilities

- Consider the nature of remote work: Whether employees work from home, co-working spaces, or while traveling.

- Evaluate the type of work being done remotely: Some industries may have higher risks than others.

- Assess the security measures in place for remote work: Data protection and cybersecurity are crucial considerations.

Impact of Location on Insurance Coverage

- Local regulations: Different regions may have specific insurance requirements that need to be met.

- Risk assessment: Locations prone to natural disasters or with higher crime rates may require additional coverage.

- Healthcare access: Considerations for workers' compensation and health insurance may vary based on the location of remote workers.

Mitigating Risks Through Insurance

Insurance plays a crucial role in helping remote work businesses mitigate financial risks. By having the right insurance coverage in place, businesses can protect themselves from potential losses that may arise from various unforeseen circumstances.

Role of Insurance in Mitigating Financial Risks

- Insurance can cover costs associated with property damage, cyber attacks, liability claims, and other risks that remote businesses may face.

- Having insurance can provide financial protection and peace of mind, allowing businesses to focus on their operations without worrying about potential losses.

- Insurance can help businesses recover and bounce back quickly in case of a covered event, minimizing the impact on their financial stability.

Real-Life Scenarios of Insurance Coverage in Remote Businesses

- A remote graphic design agency experiences a cyber attack that results in the loss of sensitive client data. Their cyber insurance policy helps cover the costs of data recovery and legal fees associated with the breach.

- During a virtual client meeting, a freelancer accidentally spills coffee on their laptop, damaging it beyond repair. Their business property insurance covers the cost of replacing the laptop, ensuring minimal disruption to their work.

Case Study: Benefits of Comprehensive Insurance in a Remote Work Environment

In our hypothetical scenario, a remote marketing agency faces a lawsuit from a client who claims their marketing campaign led to a decrease in sales. Thanks to their professional liability insurance, the agency is able to cover legal fees and settlement costs, protecting their finances and reputation.

Additionally, when a key employee of the agency falls ill and is unable to work for an extended period, their business interruption insurance kicks in to cover the loss of income during this time, allowing the agency to continue operating smoothly.

Outcome Summary

In conclusion, the discussion on the role of insurance in protecting remote work businesses sheds light on the crucial need for comprehensive coverage in today's digital age. By understanding the nuances of insurance policies tailored for virtual ventures, businesses can thrive amidst uncertainty and adversity.

FAQ Resource

What specific risks can insurance cover for remote work businesses?

Insurance can cover risks such as data breaches, liability claims, property damage, and business interruptions in remote work setups.

How does the location of remote workers impact insurance coverage decisions?

The location of remote workers can affect insurance coverage by influencing factors like local regulations, security risks, and access to medical facilities.

Can insurance help mitigate financial risks for remote work businesses?

Yes, insurance plays a crucial role in mitigating financial risks by providing coverage for unexpected events that could lead to financial losses.