As families navigate the world of insurance in 2025, finding the best bundle insurance quotes becomes paramount. This guide delves into the key features families seek, the advantages of bundle insurance, technology trends shaping the industry, and expert tips for securing the most suitable coverage.

Let's embark on this informative journey together.

Top Features Families Look for in Bundle Insurance Quotes

When it comes to choosing bundle insurance quotes for their families in 2025, there are several key features that families prioritize. These features not only provide the necessary coverage but also offer savings and convenience for the entire household.

Must-Have Coverage Options for Families

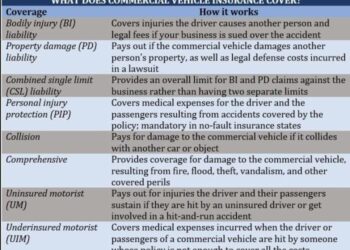

Family insurance policies should include essential coverage options such as:

- Health insurance for all family members

- Home insurance to protect their residence

- Auto insurance for all vehicles owned

- Life insurance to ensure financial security

How Bundle Insurance Can Save Families Money and Provide Convenience

By bundling multiple insurance policies together, families can often save money through discounted rates offered by insurance companies. Additionally, having all insurance policies under one provider can streamline the process of managing and renewing policies, providing convenience for busy families.

Comparison of Different Insurance Companies’ Offerings for Families

When comparing insurance companies' offerings for families, it's essential to consider factors such as coverage options, pricing, customer service, and reputation. Some top insurance providers for families in 2025 include:

| Insurance Company | Key Offerings |

|---|---|

| ABC Insurance | Comprehensive family bundles with add-on options |

| XYZ Insurance | Discounts for multi-policy holders and 24/7 customer support |

| 123 Insurance | Flexible payment options and personalized coverage plans |

Advantages of Bundle Insurance for Families

Bundling insurance policies can offer numerous benefits for families, making it a convenient and cost-effective option to consider. By combining multiple insurance policies under one provider, families can enjoy several advantages.

Simplified Claims Process

- Having all insurance policies bundled together means that families only need to deal with one insurance company for all their claims. This streamlines the process and eliminates the hassle of contacting multiple insurers.

- With bundle insurance, families can avoid confusion and delays in claims processing, as all policies are managed by a single point of contact.

- Insurance companies often offer discounts or incentives for bundling policies, making it a more affordable option for families.

Cost Savings and Convenience

- Bundling insurance policies typically results in cost savings, as providers offer discounts for combining multiple policies.

- Families can save time and effort by managing all their insurance needs through one provider, simplifying payments and renewals.

- Bundle insurance can also provide comprehensive coverage, ensuring that families have all their insurance needs met without gaps in protection.

Real-Life Scenarios

- Consider a family that bundles their home, auto, and life insurance policies with one provider. When they experience a home burglary, they only need to file one claim for all damages, making the process more efficient.

- In another scenario, a family involved in a car accident can easily navigate the claims process by having their auto and health insurance bundled together, ensuring seamless coverage and support.

Technology Trends Impacting Bundle Insurance Quotes for Families

AI and automation are revolutionizing the insurance industry, providing families with more personalized and efficient services. Data analytics plays a crucial role in tailoring insurance packages to meet the specific needs of families. Emerging tech tools are also assisting families in comparing bundle insurance quotes more easily and effectively.

AI and Automation in Insurance

AI and automation are streamlining insurance processes, such as underwriting and claims processing, making them faster and more accurate. By utilizing AI algorithms, insurance companies can assess risk factors and determine appropriate coverage for families

Data Analytics for Tailored Packages

Data analytics allow insurance providers to analyze vast amounts of data to identify trends and patterns that can help in creating customized insurance packages for families. By understanding the unique needs and preferences of each family, insurers can offer relevant coverage options at competitive prices.

This personalized approach enhances customer satisfaction and loyalty.

Emerging Tech Tools for Comparing Quotes

Tech tools, such as comparison websites and mobile apps, are assisting families in easily comparing bundle insurance quotes from different providers. These tools offer side-by-side comparisons of coverage options, premiums, and discounts, enabling families to make informed decisions. Additionally, some tools use AI to suggest the most suitable insurance packages based on the family's profile and requirements.

Tips for Finding the Best Bundle Insurance Quotes for Families

When it comes to finding the best bundle insurance quotes for families, there are several key steps that can help you navigate the process effectively. From comparing quotes to negotiating rates, here are some tips to consider:

Step-by-Step Guide to Comparing Bundle Insurance Quotes

- Start by gathering quotes from multiple insurance providers that offer bundle packages for families.

- Compare the coverage options, deductibles, premiums, and discounts offered by each provider.

- Consider the reputation and customer service of each insurance company to ensure you choose a reliable provider.

Strategies for Negotiating Better Rates

- Bundle multiple policies together, such as auto and home insurance, to qualify for additional discounts.

- Ask about available discounts for factors like good driving records, home security systems, or multiple policies with the same provider.

- Consider increasing deductibles or adjusting coverage limits to lower your premiums, but make sure you understand the impact on your coverage.

Importance of Reviewing and Updating Bundle Insurance Packages

Regularly reviewing and updating your bundle insurance packages is crucial to ensure you have adequate coverage for your family's needs. Life changes, such as new additions to your family, home renovations, or changes in driving habits, can impact your insurance needs.

By reviewing your policies annually and updating them as needed, you can avoid gaps in coverage and ensure you are getting the best value for your insurance premiums.

Final Wrap-Up

In conclusion, Top Bundle Insurance Quotes for Families in 2025 offer a convenient and cost-effective solution for ensuring comprehensive coverage. Stay informed, compare wisely, and secure the best bundle insurance for your family's needs.

Questions and Answers

What are the top coverage options families look for in 2025?

Common coverage options families seek in 2025 include life insurance, health insurance, property insurance, and auto insurance bundled together for comprehensive protection.

How can bundle insurance save families money?

Bundle insurance offers discounts for combining multiple policies, resulting in cost savings compared to purchasing individual insurance plans.

What role does data analytics play in tailoring insurance packages for families?

Data analytics helps insurance companies analyze customer data to customize bundle insurance packages based on specific family needs and risk profiles.

Why is it important to review and update bundle insurance packages regularly?

Regularly reviewing and updating bundle insurance ensures that families have adequate coverage as their circumstances change, helping to avoid gaps in protection.