Exploring the realm of Understanding Auto Insurance Quotations: The Ultimate Guide, this introduction delves into a comprehensive narrative that is both insightful and engaging, setting the stage for a deep dive into the intricacies of auto insurance quotes.

Providing a detailed overview of the key aspects surrounding auto insurance quotations, this introductory paragraph aims to captivate readers and spark their interest in the nuances of this essential topic.

Introduction to Auto Insurance Quotations

Understanding auto insurance quotes is crucial for anyone looking to purchase or renew their car insurance policy. By comparing quotes from different insurance providers, you can find the best coverage options at the most competitive rates.

Auto insurance quotations are estimates provided by insurance companies that Artikel the cost of coverage based on factors such as your driving record, age, location, and the type of vehicle you drive. These quotes give you an idea of how much you can expect to pay for insurance and help you make an informed decision.

Importance of Getting Multiple Quotes

- Getting multiple quotes allows you to compare prices and coverage options to find the best deal for your specific needs.

- Each insurance company uses its own formula to calculate premiums, so quotes can vary significantly from one provider to another.

- By obtaining multiple quotes, you can ensure that you are not overpaying for coverage and can potentially save hundreds of dollars on your policy.

Factors Influencing Auto Insurance Quotes

When it comes to auto insurance quotes, there are several factors that insurance companies take into consideration to determine the premium you will pay. Understanding these factors can help you make informed decisions when selecting coverage.

Personal Information Impact

- Your age: Younger drivers are often considered higher risk and may face higher premiums.

- Driving record: A clean driving record with no accidents or violations can result in lower quotes.

- Location: Where you live can impact your rates, with urban areas typically having higher premiums due to increased risk of accidents and theft.

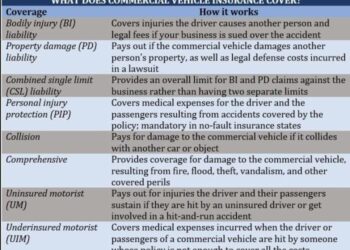

Type of Coverage and Deductible

- The type of coverage you choose: Comprehensive coverage, which includes coverage for theft, vandalism, and natural disasters, will result in higher premiums compared to liability-only coverage.

- Deductible amount: Opting for a higher deductible means you will pay more out of pocket in the event of a claim, but it can lower your premium.

Comparing Auto Insurance Quotes

When it comes to finding the best auto insurance policy for your needs, comparing quotes is essential. Here is a step-by-step guide on how to compare auto insurance quotes effectively.

Significance of Comparing Coverage Limits and Types

- Review the coverage limits and types offered by each insurance company. Ensure that the quotes provide similar coverage to make a fair comparison.

- Consider the deductible amount and any additional coverage options included in each quote. These can significantly impact the overall cost and level of protection.

- Check for any exclusions or limitations in the coverage that may affect your specific needs or circumstances.

Importance of Considering Customer Reviews and Company Reputation

- Read customer reviews and ratings of each insurance company to gauge their level of customer satisfaction and service quality.

- Research the reputation of the insurance companies in terms of claim processing, customer support, and overall reliability.

- Consider the financial stability and industry ratings of the insurance companies to ensure they can fulfill their obligations in case of a claim.

Understanding Discounts and Savings

When it comes to auto insurance, understanding the various discounts and savings options available can significantly impact the overall cost of your coverage. Let's take a closer look at common discounts offered by insurance companies and how they can help lower your insurance expenses.

Common Discounts Offered by Insurance Companies

Insurance companies often provide discounts to policyholders who meet certain criteria. Here are some common discounts you may encounter:

- Multi-policy discount: This discount applies when you bundle your auto insurance with another type of policy, such as homeowners or renters insurance.

- Good driver discount: If you have a clean driving record free of accidents or traffic violations, you may qualify for a good driver discount.

- Good student discount: Students with good grades may be eligible for a discount on their auto insurance premiums.

- Low-mileage discount: If you drive fewer miles than the average driver, you could save on your insurance costs with a low-mileage discount.

Bundling Policies and Good Credit Scores

One effective way to save on auto insurance is by bundling your policies. By combining multiple insurance policies with the same provider, you can often unlock additional discounts and savings. Additionally, maintaining a good credit score can also lead to lower insurance premiums.

Insurers view individuals with good credit as lower risk and may offer them better rates.

Understanding Terms and Conditions of Discounts

It's crucial to carefully read and understand the terms and conditions associated with any discounts mentioned in your insurance quotations. Some discounts may have specific requirements or limitations that need to be met in order to qualify. Failing to adhere to these conditions could result in the loss of your discount and an increase in your insurance costs.

Fine Print in Auto Insurance Quotations

When obtaining auto insurance quotes, it is crucial to pay attention to the fine print included in the policy details. The fine print often contains important information regarding exclusions, limitations, and specific conditions that may impact your coverage.

Common Exclusions and Limitations

Before signing up for an auto insurance policy, make sure to carefully review the fine print for any common exclusions and limitations that may apply. Some of the typical exclusions and limitations found in auto insurance quotations include:

- Pre-existing damage: Some policies may not cover damage that existed prior to the policy being issued.

- Wear and tear: Normal wear and tear on your vehicle may not be covered by insurance.

- Unauthorized drivers: If someone not listed on your policy drives your car and gets into an accident, coverage may be denied.

- Specific geographic limitations: Some policies may have restrictions on coverage in certain areas.

Implications of Not Paying Attention to the Fine Print

Failure to carefully read and understand the fine print in auto insurance quotations can have significant consequences. By overlooking important details, you may find yourself in a situation where certain incidents or damages are not covered by your policy, leading to unexpected financial burdens.

It is essential to be aware of all exclusions and limitations to avoid any unpleasant surprises in the event of a claim.

Closing Notes

In conclusion, Understanding Auto Insurance Quotations: The Ultimate Guide offers a wealth of information and insights to empower individuals in making informed decisions when navigating the world of auto insurance quotes. With a newfound understanding of the intricacies involved, readers are better equipped to secure the right coverage for their needs.

Frequently Asked Questions

What factors can influence auto insurance premiums?

Factors such as age, driving record, location, type of coverage, and deductible selected can all impact auto insurance quotes.

How can bundling policies or having a good credit score lead to savings on auto insurance?

Bundling policies and maintaining a good credit score can often result in discounts from insurance companies, ultimately reducing overall insurance costs.

Why is it important to read and understand the fine print in insurance quotes?

Reading the fine print helps individuals grasp exclusions, limitations, and terms of discounts mentioned in quotes, preventing any surprises or misunderstandings down the line.